Blockchain technology remains a niche interest in developed markets. However, the benefits of frictionless cross-border payments are increasingly evident in regions with limited financial services. Early applications—such as cryptocurrencies—were the first to demonstrate blockchain’s potential, and they remain among the most compelling. As the world globalises and the demand for cross-border payments increases, innovation in blockchain payments is expected to be driven by emerging markets in the global South.

The Need for Change

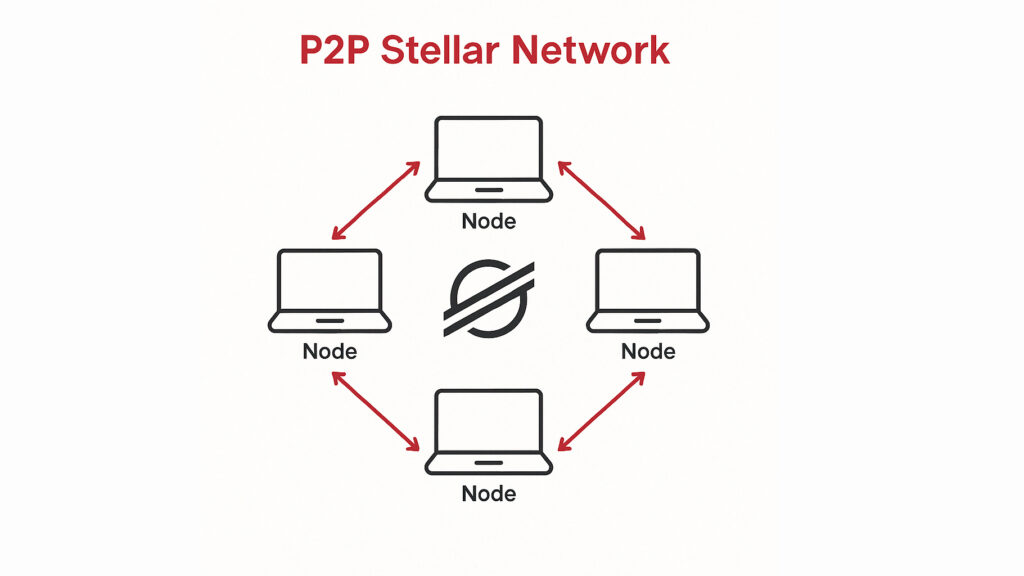

Peer-to-peer mobile payment applications may bypass traditional banks in countries where financial systems are both unreliable and expensive. We believe that a Stellar blockchain peer-to-peer mobile payments system—which uses lumens as a bridge currency—will deliver greater financial freedom. This approach allows users to transfer funds at a fraction of the cost of traditional remittance services.

This post outlines a technical proposal for a peer-to-peer mobile payments application.

Growing Demand for Blockchain Financial Use Cases

According to the World Bank’s 2018 Migration and Remittances report, remittance inflows to low- and middle-income countries reached a record USD 528 billion last year. India led as the largest recipient at USD 80 billion, followed by China (USD 67 billion), Mexico, The Philippines (each USD 34 billion) and Egypt (USD 26 billion). Meanwhile, the USA, GCC countries, and the Russian Federation rank as the top remittance senders.

Migrants seeking better opportunities abroad drive the need to send money back home. Currently, many rely on banks or expensive money transfer services. Dillip Ratha, the World Bank’s chief economist, noted in a blog post that average remittance fees approach seven per cent – more than double the Sustainable Development Goal of three per cent. He attributes these high fees to bank de-risking practices and exclusive partnerships between national postal systems and money transfer operators. Such fees disproportionately affect those who can least afford them. By enabling direct, peer-to-peer payments with fees below three per cent, blockchain technology keeps profits where they matter most—to expatriates and their families.

Our Solution with Stellar

Countries such as India, China, and Mexico not only lead in remittance volumes but also have the highest numbers of unbanked citizens, with nearly 500 million people combined, according to The Times of India. These regions are well positioned for technical solutions that bypass traditional banks. A peer-to-peer mobile payment system is one of several blockchain financial use cases that can benefit all parties involved.

Here is how:

- User-friendly Setup: Users create an account on a mobile device. In many developing regions, mobile infrastructure is more widespread and even more advanced than that in developed markets. The global South benefits from fewer legacy systems and entrenched interests, making users often more adept at utilising mobile solutions than their Western counterparts. An intuitive mobile application facilitates everyday transactions.

- Cost-Effective Transactions: The fees associated with sending and receiving funds via the application will be considerably lower than current rates. Stellar blockchain transactions confirm much more rapidly than those on Ethereum or Bitcoin and incur significantly lower fees. Although the company may charge a nominal fee to generate profit, the high costs associated with conventional money transfer services do not apply.

Fast and Secure Transactions with Stellar

We propose using the Stellar blockchain for its fast, secure transactions. As a bridge currency for crypto payments, Stellar outperforms alternative token systems such as Ethereum or Bitcoin. This system not only speeds up payment processing but also circumvents the latency challenges observed in other blockchain financial use cases.

Nevertheless, cryptocurrency-based transactions come with inherent risks related to securing private keys and managing crypto wallets. Any platform aiming for widespread adoption must clearly emphasise the importance of safeguarding these keys. Given the mature mobile infrastructure in many developing regions, however, we are confident that this application will be straightforward for users to master.

Token Distribution and Fiat Conversion

Ensuring that tokens reach users—and facilitating smooth conversions between tokens and fiat currency—remains a challenge. We envisage an ecosystem that supports users on both ends of the transaction, enabling efficient conversion between fiat and tokens.

An intuitive and secure user interface is crucial to building trust in the platform and ensuring that users can safeguard their funds. A simple yet robust software wallet within the application will enable users to store their funds securely and exchange them for fiat currency.

Technical Architecture

The application comprises two primary components: a backend layer and a blockchain layer.

- Backend:

- Manages the exchange of traditional currencies.

- Facilitates communication between the point of sale and the Central Bank.

- Handles client interactions with the Central Bank.

- Blockchain Layer:

- Utilises the Stellar blockchain to enable fast, highly scalable mobile transactions for a growing user base.

- Responsibilities include transferring assets from the Central Bank’s wallet to users and supporting direct wallet-to-wallet transactions.

Transaction Process

- A user initiates a transaction via a point of sale (referred to as ‘Issuer 1’) to exchange fiat currency for the app’s native tokens.

- Upon Issuer 1’s confirmation of a local transaction, a request is sent to the ‘Central Bank’ to commence the token transfer to the user’s wallet.

- Both Issuer 1 and the receiving party (Receiver 1) receive a transaction status update from the Central Bank. Two outcomes are possible: either the backend system is unable to generate a blockchain transaction, or the transaction is accepted and is in progress.

- Once confirmed, the Central Bank initiates the transaction on the Stellar blockchain by transferring coins from its wallet to the designated wallet. The same process applies for all issuers and receivers. Upon completion, both parties are informed whether the transaction was successful or if an error occurred.

All transaction data is recorded on the Stellar blockchain and is accessible via the Payments Explorer interface, ensuring transparency for users and the Central Bank alike.

Mobile Payments Improvement

Our blockchain-enabled application, built on traditional IT architecture, is designed for high scalability, robust data distribution, and enhanced customer ownership of their assets. Combining the Stellar blockchain with mobile payments eliminates costly intermediaries, thereby passing savings directly to users and their families abroad.

Mobile Application and Payments Explorer

The mobile application enables direct wallet-to-wallet transfers of Stellar tokens. Although the platform may support additional coins within the payments ecosystem, few alternatives offer the scalability and low transaction fees that Stellar provides. Furthermore, Stellar offers a tool to search for network transactions, enabling users to verify transaction and remittance histories easily through the Payments Explorer interface.

Conclusion

Blockchain-enabled peer-to-peer mobile payments have the potential to extend financial services to significant segments of the world’s unbanked population. In regions that receive remittances from loved ones in wealthier countries, applications that expedite and reduce the cost of money transfers ensure that more funds remain with those who need them most. Among blockchain financial use cases, seamless cross-border payments promise the greatest impact. As more people seek improved economic opportunities abroad, the demand for alternative money transfer services continues to grow. A Stellar mobile payments application, adopted by millions, may eliminate intermediaries, drive innovation, and ultimately improve lives.

This post has first been published on April 1, 2019 and has since received stylistic adjustments.