Blockchain education: Meet our meetup!

We’re just wrapped up the second edition of Poznań Blockchain Meetup. While the first edition was strictly technical, this time speakers focused on more varied blockchain matters. These included legal considerations, token types and the wider perspective on blockchain design. We’re glad to promote a more well-rounded approach to blockchain education. Here are some presentations […]

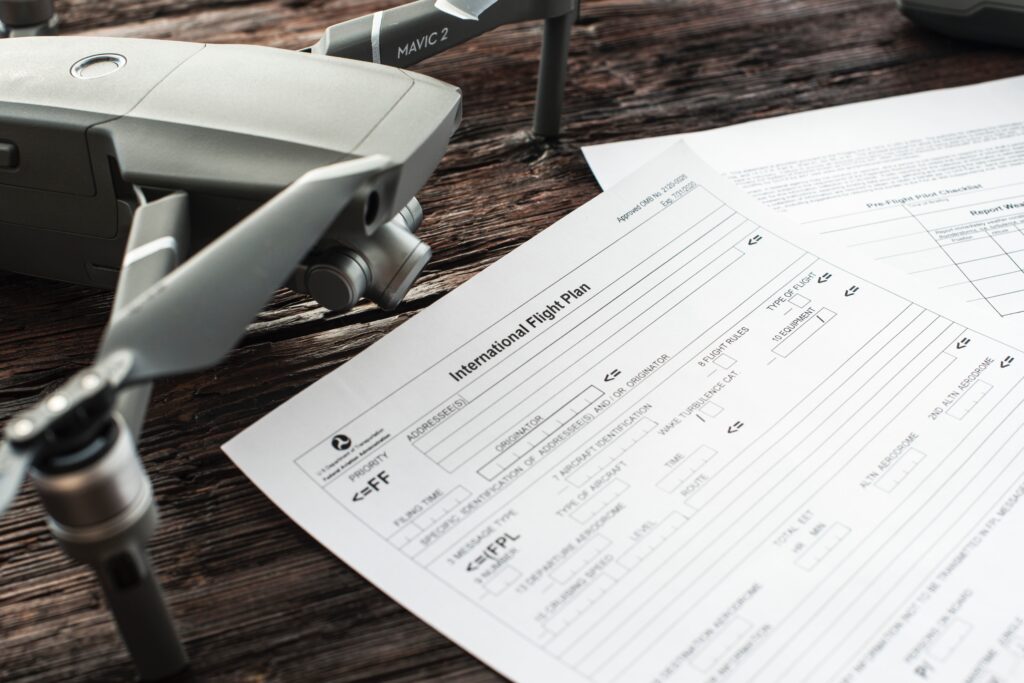

How blockchain regulation should look

Despite what you might read online, not all blockchain regulation is bad. Regulations are, in general, necessary. They help businesses thrive on markets that suffer from information asymmetry. What’s more, they also make the industry landscape clearer and sanction the government’s approach towards it. Regulations also protect customers’ interests if access to information is limited […]

Blockchain legal issues with DAOs

In my first article, I covered the benefits and possible problems that come with joining a decentralized organization. Today I’ll focus on some blockchain legal issues concerning DAOs. Keeping things safe At its core, DAO was designed as an informal group of parties which operates entirely within the algorithm of its code . Theoretically, they […]

Product Design in Agile Methodology

The standard design process divides the product preparation period into various phases, which (depending on what methodology was adopted) separate interface design and its implementation. The combination of both phases and the creation of the one team working in Agile methodology allows us to save time, speed up the implementation process and improve the quality […]