How to build a secure and customer-friendly online payment solution

Today’s era is the best time for all online service providers. The rapid growth of the e-commerce sector has given birth to innovative online payment solutions as well such as e-wallets, bank transfers, mobile apps and many more. A study by Statista says the online payment sector’s transactional value amounts to approximately $8.49 trillion and […]

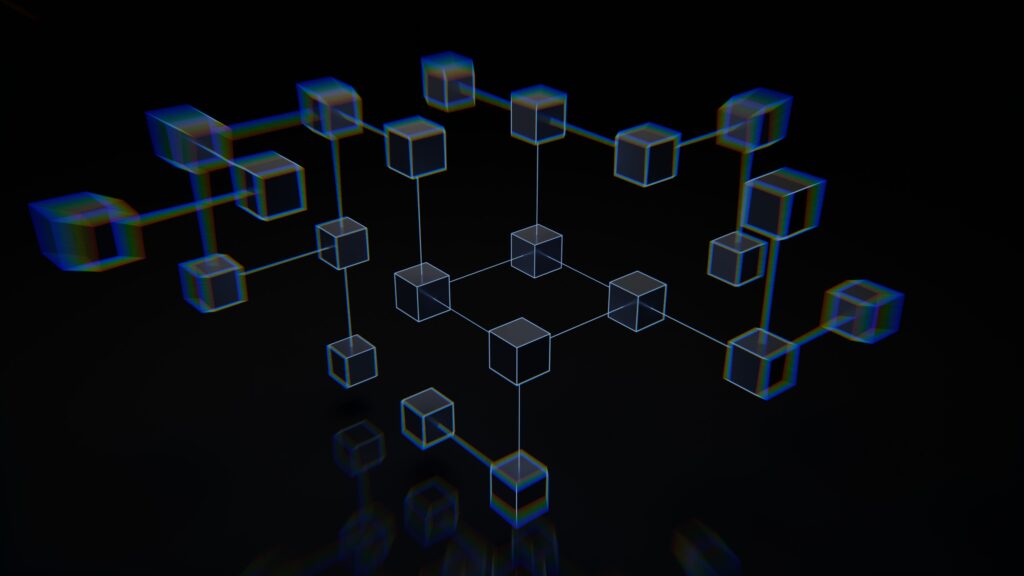

How blockchain loyalty points can save frequent flyer programs

Blockchain loyalty points could help consumers protect their frequent flyer points. Redeeming these rewards is often easier said than done. Up to 36 percent of frequent flyers say that airline loyalty rewards expire before they’re able to use them. 64 percent of airline customers also claim that airline frequent flyer programs are too complex for […]

Recurring payments vs. subscription

Though both recurring payments and subscription systems share some similarities, they are still distinct from one another. Choosing the best one without knowing the concept behind them both is challenging. With the rise of digitization and e-commerce, the demand for flexible payment options has also increased. Some businesses and customers want a subscription system, while […]

Clutch Lists Espeo Software as Top Development Company in Switzerland

“Being recognized again as a leader in software development is a huge honor as Clutch is a valuable platform for gaining the trust of companies who look for a technology partner. The businesses that find us via Clutch are strong clients who are a perfect match for what we do.” We’re thrilled to announce that […]