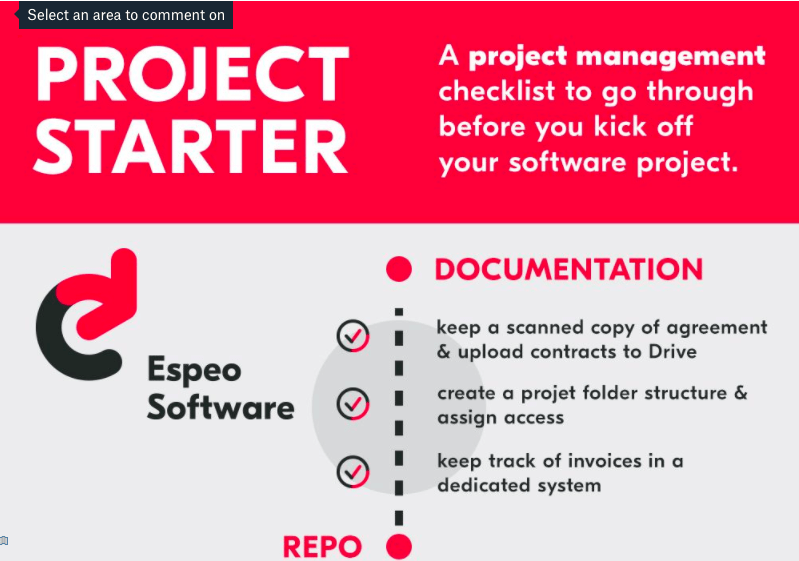

Project Management Checklist: Before You Start

Managing a project is no easy task. What makes it even harder is that if you omit or downplay an important step early on, the hurdles start mounting later. Our ‘starter’ checklist is designed to help you avoid such pitfalls and tricky situations. We’ve also made a checklist for ongoing projects to help you get […]

A practical guide to Hyperledger Fabric blockchain security

Blockchain is definitely still a buzzword in the IT world. Uses beyond cryptocurrencies continue to intrigue the business world. But how can you be sure of Hyperledger Fabric security? Stories of hacked crypto stock exchanges or their users are a never-ending story. This makes me suspect that many don’t know what they’re really doing while […]

Project management tips for ongoing projects

We’ve already covered project management tips for starting off, or how to best prepare for project kick-off. Once all the items have been checked off the list, you can get the ball rolling. However, the project manager’s work will continue for weeks — even months. Here’s what a good PM should keep an eye on. […]

Espeo Software Proud to be Named a Top Development Partner in Poland by Clutch!

Here at Espeo Software, we know it can seem tricky, especially in these unprecedented times, to attract new customers while creating cutting edge solutions. We can help you do both! We’re a digital consultancy with a strong international presence. Our seasoned team builds and designs one of a kind custom web and mobile applications to keep our […]