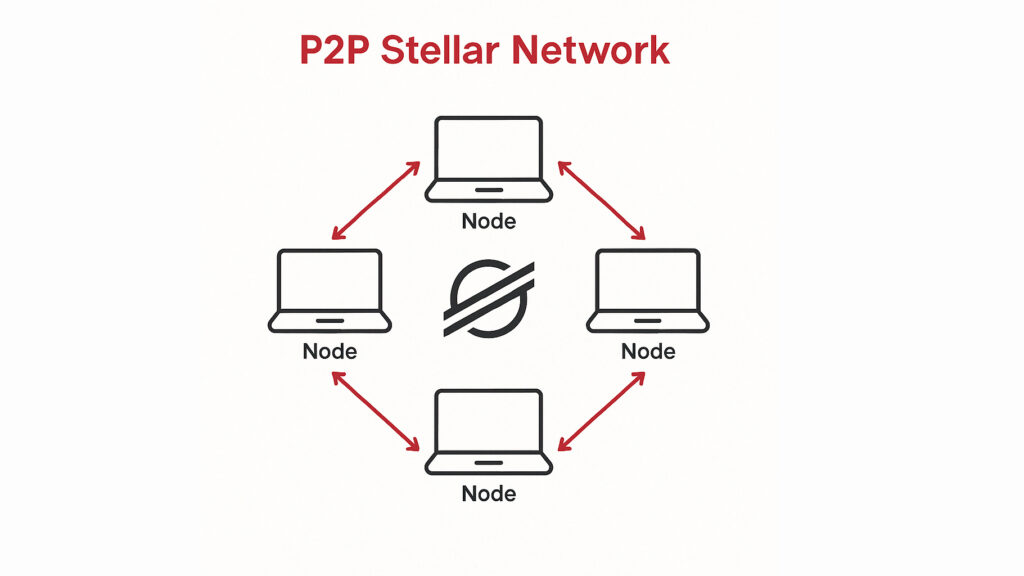

How to build a seamless Stellar peer-to-peer payments app

Blockchain technology remains a niche interest in developed markets. However, the benefits of frictionless cross-border payments are increasingly evident in regions with limited financial services. Early applications—such as cryptocurrencies—were the first to demonstrate blockchain’s potential, and they remain among the most compelling. As the world globalises and the demand for cross-border payments increases, innovation in […]

Blockchain tech companies' guide to attracting VCs

As the era of the ICO fades and new blockchain tech companies projects enter the market, entrepreneurs are looking to more conventional methods to raise capital. STOs are still an option, but attracting VC investors to your business is another method. Navigating seed round funding can seem like a huge challenge, but like any business, […]

Tips on estimating the time for blockchain software development

Following up on our recent post about blockchain ROI , I’d like to explore how to estimate the time for a blockchain software development project. This is one of the many questions our clients want to know when they’re looking for blockchain solution providers. Of course, the answer depends on several factors. As with all […]

Blockchain ecommerce is keeping the secondary luxury market honest

Florian Martigny, founder of Hong Kong-based platform Luxify plans to launch a new standard in blockchain ecommerce. Espeo Blockchain consultants laid out ways the company can leverage the technology and corner the pre-owned luxury goods market. We’d like to share how we did it and what we learned from the project. If you’re a bargain hunter with […]