IoT in healthcare: blockchain use cases and why they matter

Medical IoT devices are great at monitoring patient health and overall fitness. These sleek wearables make it easier to monitor vital signs and help doctors make much faster diagnoses. Connected devices that track pharmaceuticals from reputable sources through the supply chain is also a major opportunity for the healthcare industry. Sounds great right? But with […]

What Switzerland can teach the world about blockchain health

Switzerland is one of the leading centers of healthcare R&D in the world. Developments in life sciences on a whole are contributing to a blockchain health niche. When you hear Switzerland, you often associate it with efficiency, precision, and cutting-edge technology. And there’s a very good reason for that. As a global hub of biotech […]

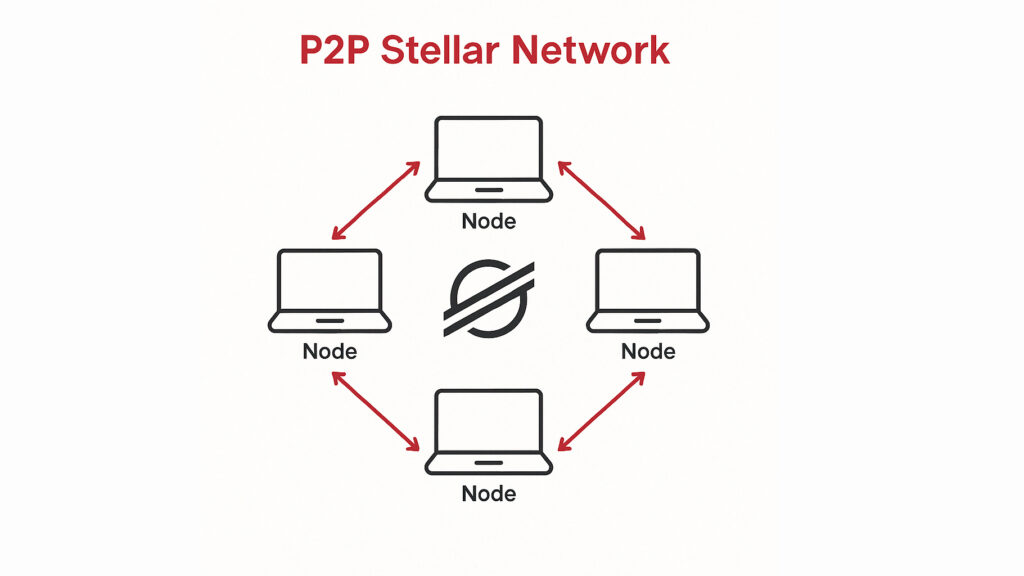

We built a P2P mobile payments system on Stellar – here is how it works

The problem to solve Our solution brings significant benefits for unbanked users, particularly in regions where financial services are ineffective or insufficient. The primary problem our application addresses is replacing banks in the payments ecosystem. We propose a system that facilitates peer-to-peer, frictionless payments and remittances by utilising the inherent features of the blockchain protocol. […]

How to build a seamless Stellar peer-to-peer payments app

Blockchain technology remains a niche interest in developed markets. However, the benefits of frictionless cross-border payments are increasingly evident in regions with limited financial services. Early applications—such as cryptocurrencies—were the first to demonstrate blockchain’s potential, and they remain among the most compelling. As the world globalises and the demand for cross-border payments increases, innovation in […]