Knowing your target audience is important to launch a successful dApp. With any dApp blockchain technology should form the basis of a product and deliver utility to end-users. So many blockchain application development projects so far have focused on the buzzwords and not on how the product will actually work. When people ask me about their dApp, they want to know why they haven’t seen much user adoption. I often have to list some of the things that could have made their blockchain application development project more profitable.

When users buy your tokens, they become part of the project in a similar way that shareholders become part of a company. Therefore, it’s important to have the interests of all actors aligned with similar goals. In this article, I will present 6 reasons why projects lack user adoption and ways to do it differently.

The dApp is unusable

Creating a profitable dApp blockchain business is all about finding the right product/market fit. Launching a product that your users will like for what it is and not because of the technology behind it is critical. After all, few really care about how services such as Paypal work under the hood.

All that matters in blockchain application development is that the product works and that it’s convenient to use in the end. Adopt this approach when dealing with any new technology, but blockchain especially.

Don’t assume that your users will know how to use MetaMask, or MyEtherWallet. The customer experience must be as smooth as possible, to remove as many barriers between the company and the customer. Good UX design also goes a long way to improving usability and building trust in any dApp

Every operation that requires an active behavior from your users (token sale, airdrop, interaction with the platform) should be an opportunity to educate them. A resource center where users can find small videos and/or presentations to guide them through your platform is essential to success.

The tokenomics model is not sustainable

Usability aside, token supply and demand play a huge role in the success of any blockchain application development project. Most dApps have a native token. Since the token — in theory — gains value, it’s important to design an economic system involving the token (tokenomics) that will regulate that value.

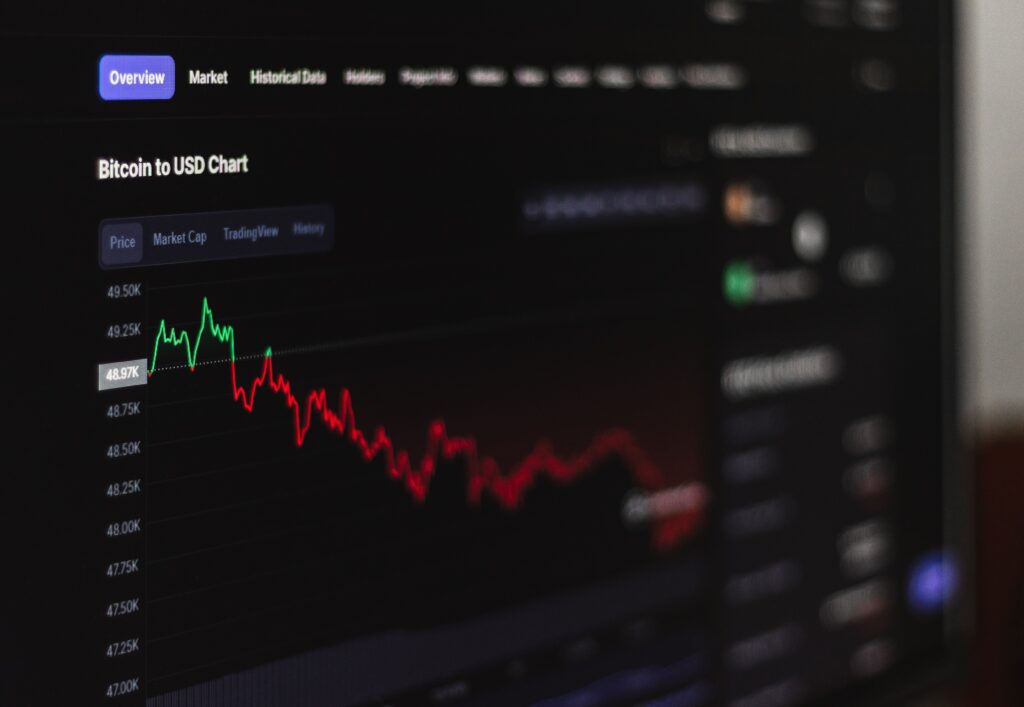

Usually, blockchain application development projects choose a deflationary model inspired by bitcoin. In the bitcoin model, there is only a fixed set of tokens in existence and because of that, the price of the token will go up.

However, this system only works for projects that aim to use the token as a store of value — as digital gold — not as a utility for the dApp blockchain platform. If we compare the storage of value effect and the utility effect of a token, there’s clearly a divergence of interests between users. Some want to use the token and thus don’t want its price to fluctuate. While others want to speculate. Since most projects are based on a utility token, the deflationary model alone does not work.

Some projects use an inflationary model, this model reflects real-world monetary systems. While this is very complex to design and set up, it brings unique advantages. One of the most famous blockchain projects implementing inflationary tokenomics is STEEM.

Carefully designing the right tokenomics model for your blockchain application development project is a crucial step that will contribute to the longevity and the economic stability of your project. Do not underestimate the importance of a well-thought tokenomics.f the token price drops to zero, the project is dead.

No one can find the token on exchanges

Once the blockchain application development is over, it’s time to list on exchanges. Centralized exchanges are big actors in the decentralized landscape. As strange as it sounds, the activity of an exchange (even a crypto exchange) is highly regulated and people have been fined and shut down for running illegal exchanges.

High listing fees and tough conditions are typical for the major players. This tremendously complicates the listing process. In order to list your dApp blockchain token with big exchanges such as Kraken or Binance, you need to have a large community and plenty of funds. If you go for smaller exchanges, users might find it difficult to use their platform and to find your token. Listing on smaller exchanges also means less liquidity.

One of the suggestions that we have is to look for alternative ways of distribution. There are different ways of distributing a token without going through exchanges. For example, airdrops, private shops, and atomic swaps are all solutions that can help consumers access tokens.

The dApp attracts the wrong crowd

Many entrepreneurs, not specifically in the blockchain industry, fail to grasp the importance of attracting the right users. They’re fooled by the lofty promises of a network effect and feel compelled to attract as many users as possible. Regardless of who they are.

A quick glance at major dApp blockchain groups on social media reveals that the main topic of conversation is the price of the token. Of course, this is usual in the crypto community. But should the price-obsessed be the main target of your platform?

At its core, there is a chasm between the interests of users who want to spend your token and the users who want to hold it to make a profit. Since your goal is to drive mass adoption of the platform, you shouldn’t target the crypto community specifically because the vast majority of its members only care about price.

If we look at how usual companies operate, the share price does not necessarily reflect how the company is doing financially. Companies like Tesla, Pinterest, Facebook do not (or did not for a very long time) generate any profits.

As opposed to companies quoted above, most blockchain projects do not have any products because they focus on the price of the token rather than building one.

The reason why internet companies have value is because of their users. User adoption is the most important metric out there. A quick look at DappRadar can show that most dApps have no more than 50 users apart from airdrop groups.

If you target users in the crypto community, yes you’ll have some traffic, yes you’ll give the impression that your project is hot. But as soon as the selling window of your tokens expires, those users will simply switch to another project.

Aside from the number of users, the quality of those users is a far more valuable measure. I always suggest my clients avoid only targeting users in the crypto community. Some of them just want to pump and dump. You want to build a sustainable decentralized business.

The airdrop was poorly organized

As explained in a previous article, airdrops can be your best tool as they can be your worst enemy. There ’s always a risk in attracting the wrong users to your profile. You don’t want to have your main communication channels polluted by a flood of “when exchange” and “when moon” messages.

On the contrary, you want to have smart users that are asking critical information about your product and engage with the community. If you do it well, a lot of the support can be performed by those same users who will educate the newcomers.

There are numerous mechanisms that can prevent users from selling their newly acquired tokens on the exchanges and causing a major drop in price while still benefiting from the exposure offered by the airdrops. However, you have to organize each airdrop in a unique way, tailor-made way. We at Espeo have a history of successful airdrops and will be happy to talk about your options with you.

The dApp does not have a clear competitive edge

Before you start a blockchain application development project, ask yourself: What is my edge, what is my unfair advantage?

Time has passed where you could simply copy an ICO website, quickly write a sloppy white paper and expect to raise $20 million. If you want to make it, you need a strong value proposition. What is your value when you’re literally using the same pitch as 100 ICOs before you, what is your edge when you develop the 10th KYC on blockchain solution that will change the world?

Building a strong project takes time, efforts and resources. Creating a fancy website, adding some animations, and hiring content writers to produce “sales-y content” is pretty easy. But what’s your edge on your competitors? What will drive the users to come to your platform, apart from the tech?

A dApp blockchain platform has to actually create value for end-users. This can get very complex and it requires an extra mile of work. It may also require a second-layer of reflexion regarding the goal and project architecture. Yes, it takes more time, but it’s worth it. We always forget the time spent on a project, but the value of a project remains. And that’s where Espeo stands for.

Our team of experts can help you strengthen your projects by understanding the technical challenges that you’ll face as tech entrepreneurs. We can help lead you toward a profitable blockchain business.

Conclusion

As already mentioned above, many dApps lack a basic proof of concept. There are a lot of new concepts, and indeed a lot of nice investor pitches. However, there are very few established prototypes. For any successful dapp blockchain technology has to actually benefit end-users. Fixing this is already something that will set you apart from your competitors.

After, all technology is a tool. But how people adapt and react to technology has not changed. This is why it’s crucial to think about the way you target your users and how you present the product. People react to what you say. If you create a project that’s simple to use and solid economically you’ll have no problems finding the right users. Before any blockchain application development project, follow a few of these tips to launch a great product the market actually needs.